Cascade School Bond

Updates, Renovations, and Repairs

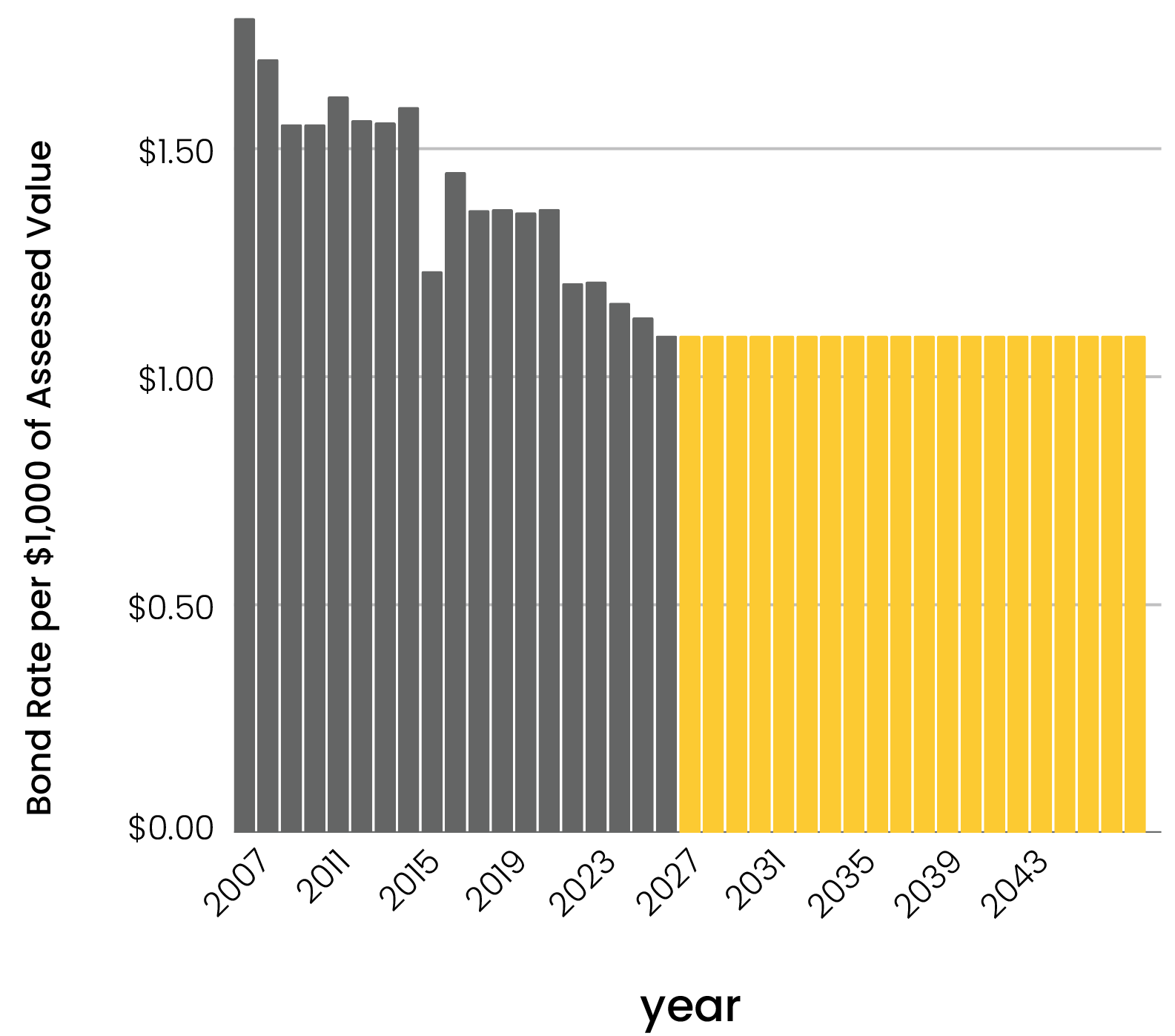

Replace Expiring Bond & Maintain Current Tax Rate

Utilize $10.2 Million in State Matching Funds

Expiring Bond Rate:

$1.09 per $1,000

Cascade School District is placing a Capital Improvement Bond on the May 2026 ballot.

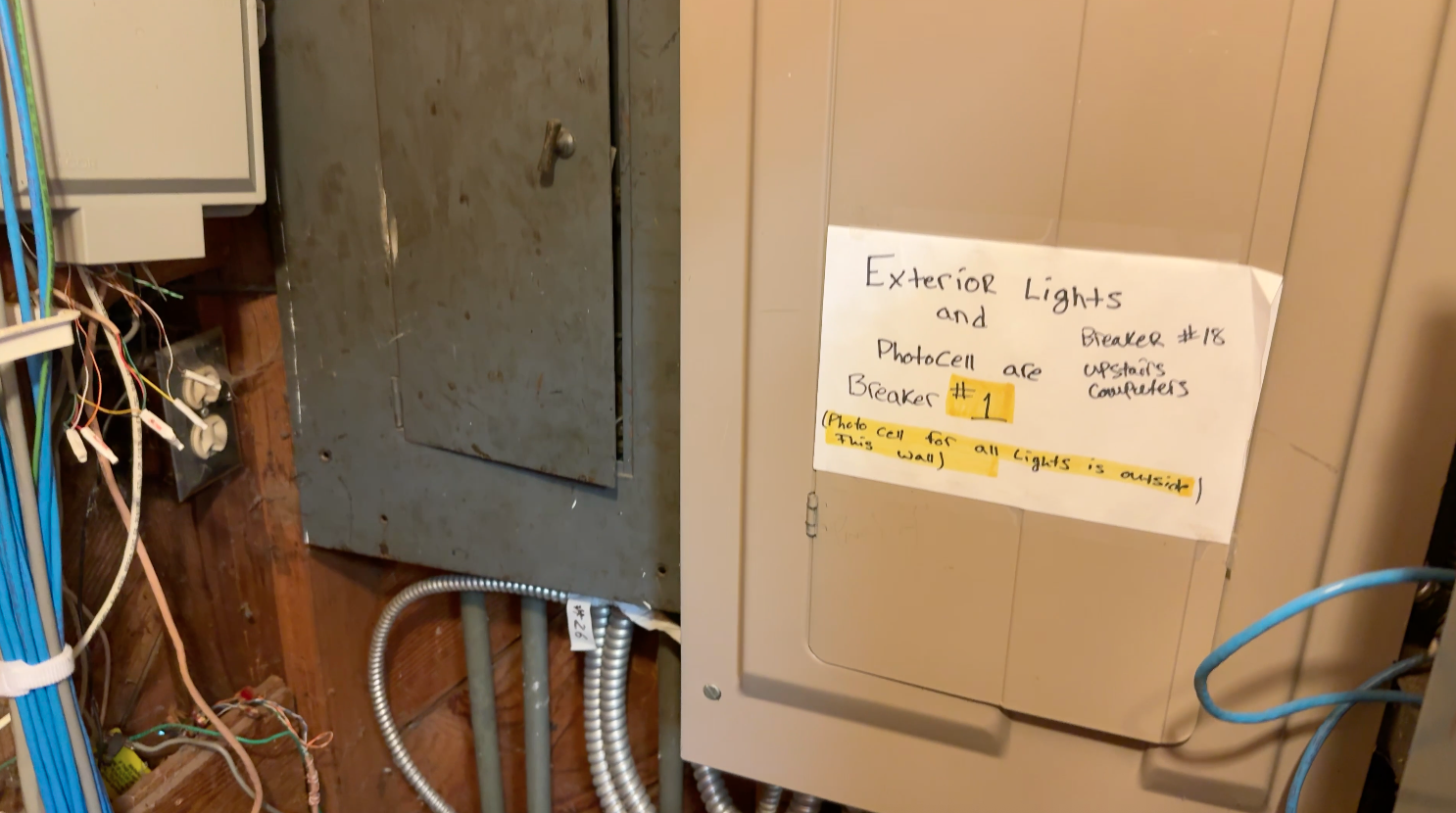

If approved, the bond would fund building repairs, infrastructure updates, and accessibility improvements identified through recent facility assessments and reviewed by a community-based Facilities Committee. Projects include work on aging roofs, electrical systems, flooring, siding, and heating and cooling equipment that have reached the end of their useful life or are missing in some schools.

Because existing bonds are retiring, the proposed $30 million bond is not expected to increase the current bond tax rate, which is estimated to remain at $1.09 per $1,000 of assessed value.

If approved, Cascade would also qualify for more than $10 million in state matching funds through the Oregon School Capital Improvement Matching Program. If not approved, the projects would not move forward, and those state funds would be awarded to another district.

Proposed Bond Rate:

$1.09 per $1,000

FAQs

General Obligation Bond Questions

-

A bond measure is used by a public school district to finance school facility projects or other capital projects. Measures are placed on the ballot along with information about the specific projects that would be completed by the district if passed by voters.

-

The $30 million bond is projected to maintain Cascade’s current estimated bond tax rate of $1.09 per $1,000 of assessed property value. No expected increase in the current bond tax rate is anticipated.

-

Before 2016, Oregon provided no state funding for school construction or major repairs, so districts relied on local property taxes and voter-approved General Obligation (GO) bonds. While the State School Fund helps cover daily operations and basic maintenance, it doesn't provide for large-scale renovations or new construction. Federal support is also very limited, leaving local bonds as the main way to fund needed facility improvements.

The Oregon School Capital Improvement Matching (OSCIM) Program began in 2016. Prior to its inception, Oregon did not provide state funding support for school infrastructure projects; districts relied on property tax revenues and General Obligation bonds to finance such improvements. The Cascade School District is eligible to receive a $10.2 million matching grant through OSCIM if this bond measure is approved by voters.

-

The District’s existing bond is set to expire, providing the community with an opportunity to consider a new bond that would maintain a similar estimated tax rate while continuing to invest in school facilities. Many of our school buildings were constructed decades ago and now rely on critical systems that are well past their expected lifespan. Roofs, windows, HVAC units, plumbing, and electrical systems are increasingly costly to maintain and present growing operational and safety challenges. This timing allows the District to present facility needs and options to the community for consideration based on current conditions and long-term requirements.

-

By law, General Obligation Bond funds can only be used for the capital projects outlined in the ballot explanatory statement. These funds cannot be used for items such as PERS, salaries, or other employee expenses, nor can they be used for routine maintenance or supplies.

A later FAQ provides a detailed list of the specific projects planned for this bond proposal, as outlined in the ballot explanatory statement.

-

To vote on a school bond, residents must live within the District and be registered to vote. In order to be registered to vote, you must be a U.S. citizen and 18 years old.

Oregonians can register to vote after their 16th birthday, but you will not receive a ballot or be eligible to vote until an election occurs on or after your 18th birthday.

To register to vote, go to https://secure.sos.state.or.us/orestar/vr/register.do?lang=eng&source=sos

-

If the measure does not pass, the proposed projects would not be completed.

Projects

-

Developed with input from community members, district staff, and facility experts, this bond proposal focuses on addressing the most urgent facility needs while positioning Cascade School District for long-term, cost-effective operations. If approved, the bond would invest in the following areas:

Districtwide Building Preservation

Repair and replace building components that have reached end-of-life to protect learning spaces and reduce costly emergency maintenance, including:

Replacement of aging roofs across all district buildings

Upgrades to heating, ventilation, and cooling systems

Update flooring, siding, ceilings, and interior finishes

Improvements to outdated plumbing and electrical systems

Septic upgrades at the main campus and bathroom renovations throughout the district

Safety, Accessibility, and Emergency Improvements

Ensure that schools remain safe, functional, and accessible for all students, staff, and community members by completing critical upgrades such as:

Improvements to building access and circulation

Update safety and accessibility features across campuses

Elevator additions

School-Specific Learning Environment Improvements

Aumsville Elementary

Renovate and modernize the 3–5 building to improve classroom quality and support student growth

Cloverdale Elementary

Construct a new 4,800 sq. ft. cafeteria/kitchen to improve food service operations and relieve pressure on overcrowded shared spaces

Turner Elementary

Build a new 5,200 sq. ft. cafeteria/kitchen designed to accommodate current needs and plan for future enrollment growth

Cascade Junior High / High School Campus

Renovate PE and activity spaces, including resurfacing the track and renovation of upper gym

Total Investment Plan

The recommended package reflects approximately $40.2 million in total bond and development funding. The $30 million bond is projected to maintain Cascade’s current estimated bond tax rate and would make the District eligible to receive a $10.2 million matching grant from the State of Oregon, reducing the amount needed from local taxpayers.

-

If the bond measure is passed by voters, the district would start the process of hiring a contractor to work with the district’s architect to start the design and planning phase. The district would work with the contractors and architects to create a project timeline projecting when projects would start and be completed.

-

The district would prioritize scheduling projects during summer break if a bond measure is passed. If projects are scheduled while school is in session, plans would be made to limit disruptions and protect students.

Facilities & Property

-

In 2024, the Oregon Department of Education launched a Statewide School Facilities Assessment, a no-cost opportunity for local districts made possible by federal funds through the Supporting America’s School Infrastructure program. Over a five-year period, this effort aims to evaluate the condition of every public school building in the state.

As the state was launching this effort, our district recognized the importance of understanding the true condition of our facilities. That’s why we commissioned an independent, in-depth assessment of every building funded through a state grant. These assessments were reviewed by a local Facilities Committee made up of community members, staff, and experts. This work laid the foundation for identifying critical needs and informed our ongoing planning.

You can access videos sharing an overview of what was learned through these assessments and the District’s assessments by visiting https://www.cascade.k12.or.us/facilities.

-

Building a school typically costs more than constructing a residential or small commercial building for a variety of reasons including:

specialized design and functionality,

the size and scale of the building,

higher occupancy load,

regulatory compliance,

educational standards,

specialized accommodations, and

safety requirements.

Schools require specialized design features to meet educational needs. This includes:

classrooms,

science labs,

libraries,

gymnasiums,

and administrative offices.

Each of these spaces must be carefully designed to support effective teaching and learning.

Schools are generally larger in terms of both square footage and overall scale compared to residential buildings. Schools have higher occupancy loads compared to residential buildings. This requires more extensive infrastructure, including fire safety systems, plumbing, electrical systems, and ventilation, to ensure the safety and well-being of a large number of people.

There are specific educational standards and regulations set by state and national educational authorities that school districts must comply with that can increase construction costs. This includes requirements for classroom size, accessibility, technology infrastructure, and safety features. School buildings must comply with local zoning codes, building permits, and adherence to educational facility standards.

In addition, schools often have specialized amenities like sports facilities, auditoriums, music rooms, and computer and science laboratories. These facilities require additional construction and maintenance costs. Schools may need extensive site preparation, including grading, utilities, parking lots, and outdoor play areas. This can be more complex and costly compared to the site requirements for a residential building. Schools must be designed to accommodate a diverse range of students, including those with disabilities. This may require additional features such as ramps, elevators, and accessible restrooms.

Schools also require specific security measures to ensure the safety of students and staff. This can include controlled access points, security systems, and emergency response protocols, which can add to construction costs.

Additionally, the District must pay prevailing wage on all school construction projects, which is the amount that must be paid to construction workers on all public works projects in Oregon. Prevailing wage rate laws ensure local participation and community established pay standards on publicly funded projects. These rates include fringe benefit wages to encourage employers to purchase health insurance and other benefits for their workers.

Facilities Grants

-

The Oregon School Capital Improvement Matching (OSCIM) Program provides matching grants to districts that pass a local general obligation bond. If the bond measure passes, the state would provide the District with a $10.2 million matching grant. This would provide the district with additional funds for facility improvements. If the bond measure does not pass, the District would not receive matching funds from the state.

-

The Technical Assistance Program (TAP) helps districts plan for capital improvements and expansion so they can inform residents about deferred maintenance, future enrollment and explore sources of funding for school facilities. TAP provides four types of grants to school districts to cover or offset the costs of conducting:

Facilities Condition Assessments;

Long-Range Facility Planning;

Seismic Assessments, and;

Environmental Hazard Assessments.

The Facilities Assessment and Long-Range Facility Plan are required as part of the Oregon School Capital Improvement Matching (OSCIM) Program grant application. The Seismic Assessment is a required component of the application to Business Oregon’s Seismic Rehabilitation Grant Program, through which school districts can apply for funding to retrofit buildings. From 2019 - 2021, the Radon Environmental Hazard Assessment Grant helped nearly half of all districts in Oregon pay for radon testing to comply with Oregon Health Authority’s ORS 332.341 and 332.345. Starting in 2022, the Asbestos Environmental Hazard Assessment Grant will help districts meet the federally mandated requirements of the Asbestos Hazard Emergency Response Act (AHERA) by covering the costs of asbestos inspections, periodic surveillance, AHERA-related training for staff, and upgrading to a web-based record-keeping system.

Please refer to the Oregon Administrative Rules (OARs) under Chapter 581, Division 27, for definitions, grant program procedures, and reporting requirements for the grants listed above.

-

The Seismic Rehabilitation Grant Program (SRGP) is a competitive initiative by the state of Oregon, administered by Business Oregon, designed to enhance the seismic resilience of critical public buildings, including schools. The program offers grants of up to $2.5 million per building to support structural improvements that enable facilities to better withstand earthquakes.

Our district has effectively utilized SRGP funds to strengthen several school buildings, ensuring the safety and well-being of our students and staff. Below is a summary of the projects undertaken:

Turner Elementary Original Building: In the 2016-17 fiscal year, we removed and replaced the exterior stucco and roof, resheathed the entire building, and added tie-downs to the roof, walls, and ground. This project was completed on time and within budget.

Cloverdale Elementary Original Building, First Addition, and Gym: In the 2018-19 fiscal year, we anchored beams throughout the structure, tied the basement to the ground, and installed beams tying the gym to the first addition. This project was completed on time and within budget.

Junior High Original Building with Music Wing: In the 2021-22 fiscal year, we strengthened connections to walls and supports throughout the building, resheathed the roof, and addressed exposed walls. This project was completed on time and within budget.

High School Original Gym and Locker Rooms: In the 2022-23 fiscal year, we added multiple structural supports for the large tilt-up concrete building, installed flooring ties, and made improvements to the lockers. This project was completed on time and within budget.

These projects, totaling $7,097,240, have been completed on time and within budget, significantly enhancing the seismic safety of our facilities. By leveraging SRGP funds, we have ensured that our schools are better equipped to withstand seismic events, providing a safe learning environment for our students.

-

The Elementary and Secondary School Emergency Relief (ESSER) Fund is a federal program established to support schools in addressing the challenges posed by the COVID-19 pandemic. These funds are allocated to state educational agencies, which then distribute them to local school districts. The primary objectives of ESSER funds include mitigating learning loss, enhancing educational technology, and improving school facilities to ensure safe and effective learning environments.

Our district has effectively utilized ESSER funds to enhance our educational facilities without imposing additional tax burdens on the community. Over the past couple of years, we have undertaken several significant projects:

Turner Elementary: In March 2022, we opened four new classrooms to accommodate growing enrollment and provide a more conducive learning environment.

Cloverdale Elementary: In November 2022, we added four classrooms—two funded by fire insurance proceeds from two portables that burned, and two covered by ESSER funds—to meet the needs of our students.

High School Science Classrooms: In December 2023, we opened four state-of-the-art science classrooms equipped with modern equipment, enhancing our science programs and providing students with advanced learning opportunities.

These improvements have been made possible through strategic financial planning and the use of ESSER funds, allowing us to enhance our facilities and educational offerings without additional costs to our community. -

Cascade High School utilized the $190,500 Career and Technical Education (CTE) Revitalization Grant from the Oregon Department of Education to fund the construction of a new, larger barn for the Agricultural Learning Hub. This grant supports the development and enhancement of CTE Programs of Study, aiming to meet workforce needs in high-skill, high-wage, in-demand occupations.

The new barn will provide a versatile and accessible space for agricultural classes and events, enhancing the Future Farmers of America (FFA) program and fostering community partnerships. This initiative aligns with the grant's objective to strengthen existing CTE programs and create new ones that support student engagement and success, leading to career and college preparation. Cascade is working with local contractors to build the barn.

By investing in this facility, Cascade High School aims to offer students hands-on learning experiences in agriculture and livestock, thereby contributing to local and regional economic development.

-

Aumsville Elementary: We installed an all-inclusive playground, ensuring that all students, regardless of abilities, have access to safe and engaging play spaces. The funding came from several federal and state grants

Cascade High School: We completely renovated the cafeteria thanks to winning a $149,825 Healthy Meals Incentive Grant from the USDA in 2024. New steam combi ovens and completely new service lines mean we can serve more fresh and healthy food to our students.

Finances

-

The current bond rate for the District is $1.09/$1,000 assessed value. If approved by voters, no increase in the bond tax rate is anticipated.

When the current bond was passed in 2005, the rate was $1.78/$1,000, but it has been lowered through refinancing by the District. School districts in Oregon may refinance existing general obligation bonds to take advantage of lower interest rates, much like refinancing a home mortgage. This reduces the overall cost of borrowing and saves taxpayers money without extending the life or purpose of the original bond. While it does not provide new funds to the district, refinancing can lower future tax levies or help avoid increases, making it a fiscally responsible move that directly benefits the community.

-

The Estimated District Property Tax Rates if measure passes would remain the same: $1.09 per $1000 of assessed property value. No increase in the bond tax rate is anticipated

-

The assessed value of a home is generally used for tax purposes including calculating the bond rate. Oregon began using assessed value for tax purposes through the passage of Measure 50 in 1997. Though homeowners usually want their property values to grow over time, in this case, it’s better when the home’s value is lower. That’s because the higher the assessed value, the higher the property taxes.

Market value is used by lenders, buyers and sellers to estimate the appropriate selling price given current market conditions. It’s essentially the value that assessors attempt to come up with before applying the assessment rate. An easy way to think about market value is this: What would a prospective buyer be willing to spend on a particular home and/or what would the seller be willing to accept if it were sold today?

Form more information about assessed value vs real market value, go to this informational video from the OACTC https://www.youtube.com/watch?v=oQ_BkTQZmCg&t=78s

For more information about how to understand your tax bill, go to the Marion County Assessor’s website at https://www.co.marion.or.us/AO.

-

To find out the assessed value of a property, go to the Marion County Assessor’s website at https://mcasr.co.marion.or.us/.

-

It is possible that the rate could change. Housing construction, area growth/decline, and home values could all contribute to changing the rate per thousand of assessed value.

The Marion County Assessor would calculate the actual property tax rate sufficient to make the first year's payment on the bonds if the bond measure passes. The first year and every subsequent year after a possible bond measure passage, the assessor would make that actual rate calculation based on the actual assessed property values of the District and the bond payments that are due in that particular year. If the current estimates for assessed value and bond payments vary each year from the actual numbers, then the rate could stay the same, decrease or increase.

-

Oregon's school finance system is complex, blending state, local, and federal revenues to support 197 school districts and 19 Education Service Districts (ESDs). The primary funding mechanism is the State School Fund (SSF), which allocates money based on a statutory equalization formula that combines state appropriations and local revenues, such as property taxes. This system is designed to ensure equity among districts with varying local wealth.

Key Revenue Sources

State Contributions: Oregon's legislature provides K-12 education funding through three primary sources:

General Fund (primarily income taxes),

Lottery receipts, and

Corporate Activities Tax

These contributions form the SSF, which totals $10.2 billion for the 2023-2025 biennium, representing about 66.5% of the funds distributed to schools.

Local Revenues: Local contributions, largely from property taxes, provide another significant portion of school funding. For 2023-2025, local revenues are estimated at $5.1 billion, making up about 33.5% of total funding. These local sources include:

Property taxes, the County School Fund, the Common School Fund, and revenues from state-managed timber trust lands.

Oregon also allows districts to ask voters for additional funding via a "local option" tax, but this is capped to prevent wide disparities in district funding.

Federal Funding and Grants-in-Aid: In addition to state and local sources, schools receive federal grants, particularly for specific programs like Title I (for high-poverty schools) and special education. For 2023-2025, federal and state grants-in-aid, including those from the Corporate Activities Tax, provide significant additional funding for specific purposes, such as nutrition programs and professional development.

School Funding Distribution

The SSF and local revenues are distributed using an equalization formula that adjusts for each district’s specific needs, ensuring equity across Oregon. Factors like teacher experience, transportation costs, and a district’s student population (measured by a weighted student count) influence the allocation of funds. For example, students in poverty or English language learners receive additional weighting in the formula to reflect their greater educational needs. The goal is to ensure that all students, regardless of their district’s wealth, have access to comparable educational resources.

-

Information about the District’s finances and the adopted budget, can be found on the district website at https://www.cascade.k12.or.us/budgetandfiscal

Community Oversight

-

If the bond measure passes, the School Board would appoint a long-term citizens bond oversight committee to review how property tax revenues are spent and ensure that proposed projects are implemented as voters intended.

-

If the bond measure passes, the District would appoint a citizens bond oversight committee made up of community members, parents, and district staff to actively monitor the progress of the bond program, ensure bond revenues are used for purposes consistent with the voter-approved bond measure and consistent with state law. The bond oversight committee would report to the school board.

How Schools Affect the Local Community

-

Communities with good schools can impact home values, encourage people to stay and invest in the local area, and can supply the local economy with better skilled workers. Additionally, good schools can improve community pride, connections, and a sense of belonging.

-

A community with good schools can positively affect home values, area pride, business attractiveness and help shape the future workforce. Students can go on to be skilled workers and engaged citizens that contribute to the local economy and community in various ways. School facilities provide community organizations gathering spaces for sporting activities and various events.

Contact Us

Do you have a question that was not answered above? Let us know!